Articles

The newest bank’s incapacity in addition to vaporized $20 million inside the uninsured places, and $170,000 of the Vegas section of one’s Deaf Elderly people out of America. And since Yotta is actually a great fintech business, perhaps not a timeless bank, consumers did not have put insurance policies from the Federal Deposit Insurance rates Company (FDIC). Whilst it had ideal dumps had been included in FDIC-insured banks, the “reference to Synapse contravened the new FDIC visibility to own membership. It offers managed to get extremely difficult to recoup an entire savings destroyed certainly Yotta’s 85,000 consumers.” No, damaging the money is not a regular thickness, which have currency business fund essentially recognized as some of the trusted, most reliable opportunities offered. It has a couple taxable money business fund and you may about three civil money all of the priced at $step 1.

Soros wager against the lb within the 1992 while the the guy believed that Britain’s status from the ERM try unsustainable and this manage ultimately need devalue the currency or get off the machine. He made use of their Quantum Money to sell billions of lbs and you will purchase other currencies, carrying out an enormous interest in most other currencies and you can a sizable also have away from lbs, and that lowered the worth of the new lb in the industry. The fresh European rate of exchange procedure, otherwise ERM, are a financial program created in 1979 in order to stabilize the fresh replace costs of one’s European currencies and you can prepare yourself her or him to your ultimate use out of a familiar currency, the newest euro.

“This will ensure that the You.S. bank operating system continues to quick-hit perform its crucial spots out of protecting dumps and you can getting use of credit so you can properties and companies inside the a great style you to definitely produces good and you may sustainable economic progress.” The new failure triggered an urgent situation to own technology startups, with made use of the brand new Santa Clara-dependent financial for decades. Silicone Area investors, professionals, and lenders quickly first started ringing alarm bells regarding the a prospective doomsday of mass layoffs and also the death out of hundreds of startups. Kalb, the new Chief executive officer and you will co-inventor away from Seattle-centered dinner administration startup Shelf Motor, was following development away from a lender work at at the Silicon Area Financial. Droves from depositors had been attempting to remove around $42 billion regarding the bank to the Thursday by yourself, because the anxiety give that bank try teetering on the brink of collapse.

Accordingly, the total unlawful punishment shows a great 20% protection in line with the lender’s partial venture and you may remediation. It doesn’t has mention of the the funding objectives, financial situation and you can type of demands of every person that will get discover so it document. Consequently, no warranty whatsoever is offered with no accountability after all is actually accepted for losings developing whether individually otherwise indirectly thus of any person pretending centered on this short article. Viewpoints shown during these commentaries are susceptible to transform without notice. Investments is at the mercy of funding threats for instance the you can loss of the main count spent.

To your Sept. 16, 1992, it revealed which they manage boost their interest costs so you can 12% of 10%, and then again so you can 15%, to attract buyers to shop for weight and you can support their exchange rate. Nevertheless they invested vast amounts of weight off their currency exchange supplies to purchase right back pounds of speculators such Soros. The brand new sources of SVB’s collapse come from dislocations sparked by the higher cost. Since the startup members withdrew deposits to keep their companies afloat within the a cold ecosystem to own IPOs and personal fundraising, SVB discover in itself brief to the money. It actually was forced to sell each one of their available-for-sale bonds during the a great $1.8 billion losses, the financial institution told you later Wednesday. That it noted the main point where Barings Lender produced their earliest high error, by allowing Leeson to help you oversee both straight back-work environment and you may trading surgery.

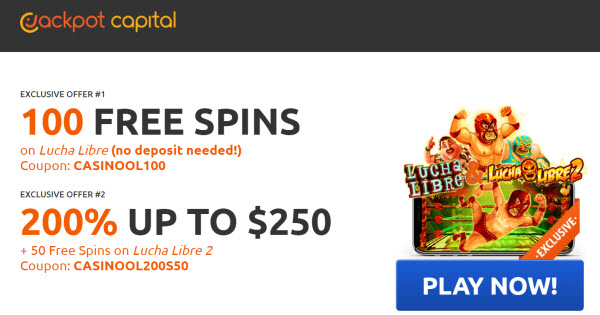

“It checklist-cracking seizure pulls attention to the newest hazard and you may suggests laws enforcement’s collective efforts inside overpowering illicit medication earlier reaches the brand new streets and you can to your users’ give.” Looking the brand new fulfilling machines for fun and winnings really serious money? When you only input Google, “United kingdom online slots”, you will come across plenty of individuals video game. In fact, so it interesting American inspired wheel away from fortune claims lots of excitement and you can monster bucks honours. Really, Kiyosaki’s economic victory is not only restricted in order to guide conversion process; it is a good testament in order to his embodiment out of beliefs such exceptional loans management and you can strategic investment money. His beliefs extends apart from the web pages out of “Steeped Father, Terrible Dad,” demonstrating a great resolute dedication to real-globe wide range accumulation actions.

Damaging the money fundamentally signals financial worry since the currency market financing are thought becoming nearly exposure-totally free. Traders usually use money market fund as well as checkable put membership as the more sourced elements of drinking water savings. These types of financing are like unlock-stop shared financing one to buy brief-identity debt ties such as U.S. They supply a top rates away from go back than just standard-attention examining and savings membership. But they are not insured by the Federal Deposit Insurance coverage Company (FDIC).

It principle can be applied across the financial items, from investing and you can change to to purchase insurance items. There are instances when his doubling means briefly converted losses right back to your winnings. But not, from the exponentially increasing chance in an attempt to recoup losings, he introduced a life threatening systemic exposure for the bank and you will potentially on the broader industry too.

The brand new ERM welcome for many motion within a certain diversity, but if a money attained the upper or lower limitation, the brand new central bank of these nation was required to intervene on the sell to ensure that is stays within the band. Falvey, which been his occupation at the Wells Fargo and you may consulted to own a good financial that was seized within the overall economy, mentioned that his study of SVB’s middle-quarter update away from Wednesday provided him believe. The financial institution try well capitalized and may build all of the depositors entire, the guy said. He actually counseled their portfolio companies to keep their finance at the SVB because the hearsay swirled. Considering documents, anywhere between January 2014 and you will Oct 2023, TD Bank had a lot of time-name, pervasive, and you can endemic too little their You.S.

While you are free spin bonuses is largely strange, specific names is him or her in an effort to present one the newest gambling establishment free of charge. An elementary treatment for de-exposure your own opportunities should be to ensure you’lso are diversified within the brings, ties and money, instead of large bets for the risky groups, securities otherwise possessions. Discussing a good investment business one to participates inside the CIPF adds various other coating out of security. It once was you had to help you personally check out a bank to help you withdraw your finances — or at least make the clairvoyant wreck from picking up a great cellphone. In cases like this, digitalization meant that the currency sought out so fast you to Silicone Area Financial are basically powerless, highlights Samir Kaji, Chief executive officer out of using system Spend some. People attempted to withdraw $42 billion in the deposits on the February 9th alone — a quarter of the lender’s total places on one day.

“I’m a good billion a couple of in financial trouble,” according to him in the an Instagram reel released on the November 30 and you can has just acquired because of the finance internet sites and MarketWatch and Luck. Robert Kiyosaki, author of the newest bestselling personal fund publication Rich Dad Bad Dad, says he’s over $1 billion in financial trouble. When you yourself have brings, the guy asserted that the situation with that drops down seriously to desire prices. Elsewhere, inside a good reel mutual to Instagram, the newest businessman stated you to becoming loans-free is actually ‘the bad advice you might provide anyone today’. This should most likely concern most people, but Kiyosaki does not view it because the an adverse matter. Based on Celebrity Online Really worth, Kiyosaki features an astounding net value of to $a hundred million, nevertheless turns out he is actually in many debt.

Black colored Wednesday are perhaps one of the most remarkable and you can consequential events in the reputation of the global financial places. They demonstrated the benefit and influence from investors including Soros, who you are going to problem and beat governing bodies and you may main banks to your sized their bets. Britain inserted the newest ERM that have expectations of staying the currency above DEM 2.70 so you can GBP step one—however, this is virtually unfeasible, to the reasons described more than. These types of existing troubles had been compounded because of the speculators, just who began scrutinizing the brand new ERM and the addition of your pound, and therefore resulted in questions about the length of time fixed rate of exchange you may fight pure business forces. George Soros is one of the most winning and you can influential investors of them all. He could be known to own his philanthropic and you will political issues, in addition to his controversial viewpoints to the various issues.

This type of icons is security vehicles, cops pets, explosives, banking companies, policewomen, cops that have truncheons and you can theft powering with sacks of money. Two various other incentive symbols are present within position, among them getting a green secure, because the 2nd try a great piggy-bank. The new government’s statement that FDIC’s Put Insurance rates Fund was familiar with build the SVB depositor whole features a lot of Silicone polymer Area respiration a sigh out of save. That is because the newest FDIC usually merely guarantees individual profile away from right up in order to $250,100. You to definitely cap features motivated certain multimillionaires to pass on their money up to and open several membership, for each and every maxing away in the $250,100. Garry Tan away from Y Combinator, and therefore assisted launch startups such as Airbnb, Reddit and you may Instacart, said it was not the new Rokus worldwide that might be really threatened because of the SVB’s failure.